Dear readers,

below my view on $AAPL situation as one of the most relevant $NSDQ100 stocks.

1 – After Covid-19 / Economic downturn impact

Apple issued a press release on February 17th, stating it no longer expects to meet its revenue guidance provided on January 28th. The Covid-19 virus has directly impacted iPhone supply and demand. The iPhone supply chain will be temporarily constrained, as smart phone sales experience lower demand throughout the world. Although Apple’s manufacturing site is outside of the directly hit areas in China (Hubei Province), the Chinese government is limiting manufacturing as a precaution. Most Apple stores throughout the world remain closed, however the 42 Apple stores in China have now reopened after closing in February. Apple has always maintained a strong online e-commerce platform, which has helped the company through this turbulent time.

2 – Positive Outlook

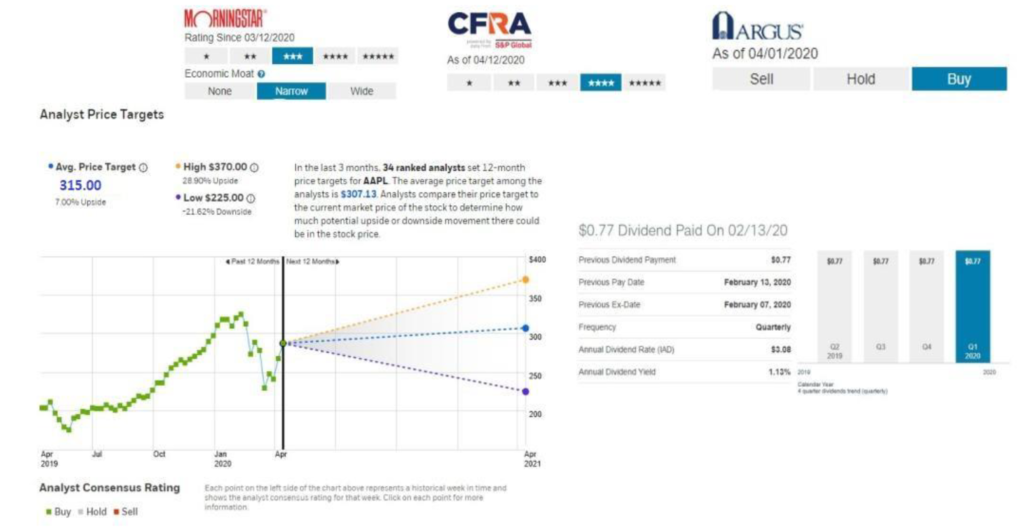

Heading into the Covid-19 pandemic, Apple maintained high customer retention rates and free cash flow. These two benefits should offset the near-term impact of the virus. Apple will see declined sales in the weeks and months, however the roll out of new services (video streaming, magazine subscriptions, gaming, and health care) could offset these losses. The 12-month target price is between $225 and $370; this is based on P/E of 19.6x and an EPS estimate of $16.31. Currently the stock price is around $280, offering significate upside to investors looking to enter a position.

3 – Future perspectives

The Covid-19 pandemic is clearly impacting global supply chains and customer demand. Apple has evolved as a global commodity, relying on continuous sales and returning customers. If the world struggles with this virus, Apple will battle to rebound to its record high. Apple’s decision to maintain a premium pricing strategy could impact sales, especially if the economy continues to spiral into a recession. Typically, tech companies, experience high levels of down-turn during a recession as consumers look to minimize household budgets. Fundamentally, Apple is believed to be behind firms like Google and Amazon in artificial intelligence (AI) development. This could be problematic in the future as tech firms look to integrate AI into premium services.

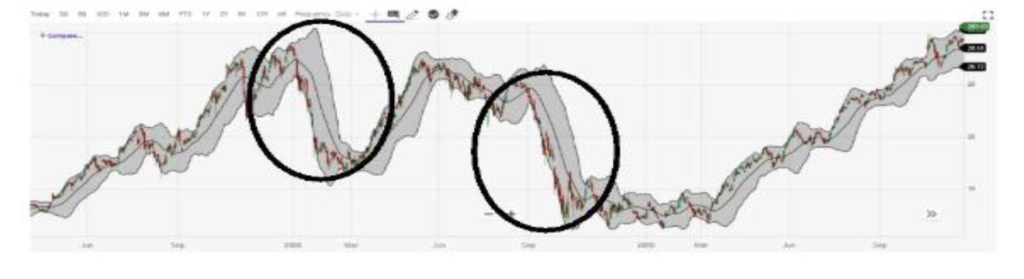

Comparison with the Global Financial Crisis

During the global financial crisis of 2007-2009, Apple’s shares plummeted from a record high at that time of $28, down to a low of $16. This represents a decline of 43%. However, it is important to note that this was not a historic low during the initial crash. Early in 2008, Apple shares were trading at the same level as they were during the crisis. Furthermore, it only took 4 months to recover back to their record high of $28.

Apple did experience long term impact during the Global Financial Crisis. As unemployment rates increase and default rates skyrocketed on home loans, consumer spending significantly decreased.

Towards the back end of 2008, Apple reported declined sales, and thus sinking the stock prices to historic lows of $11.

Apple was not the colossal company it is today during the Financial Crisis. The release of the first iPhone was in 2007; its sales did not start to take off until 2008-2009. Once sales increased and America slowly moved out of recession (2009-2010), Apple shares skyrocketed. From 2009 to 2012, Apple shares rose from $12 to $90.

In comparison, during this current pandemic, Apple shares plummeted from a record high of $327 down to $212; this represents a decline of 36%. This is lower than experienced during the financial crisis. Furthermore, Apple has already rebounded back to $273, which represents a decline from its record high of only 16%. Apple is well prepared to handle this current financial crisis, however, is at the mercy of consumer spending. The roll out of new services could offset some of the losses.

Apple will be reporting earnings in the coming weeks and will provide important information on company strategy for the year to come.

Don’t forget to subscribe our NEWSLETTER to stay updated!